Wafer-scale AI and robotaxis pull in mega-rounds; fusion, LFRs, and silicon quantum ride mixed public–private capital; circular composites, pigments, and pollination turn infra-grade & more | DTCM 56

💰The Week’s State of Deep Tech Capital: who’s Raising, who’s Betting, and why.

Welcome back to Deep Tech Capital Movements.

Each week, we monitor Deep Tech capital flows across the globe – startup rounds by geography, sector, and technology, plus new and closing funds – and turn that flow into a reference point for dealflow, benchmarking, and strategic focus.

Greetings!

In this edition, 57 deep tech capital events have been monitored: 51 new company financings and 6 fresh funds and investment vehicles aimed at deep tech.

That combined view matters, because it links near-term deal flow with the longer-term pools of capital that will underwrite the next waves of deployment.

Several patterns emerge from this week’s monitoring.

The first is geographic: the United States and Europe still account for most financings, but activity in Asia, Oceania, the Middle East and Canada is regular enough to matter for strategy and sourcing.

The second is industrial: energy and climate infrastructure, AI and data plumbing, and advanced chips and quantum platforms form the backbone of current investment, while robotics, industrial and materials, food systems, healthcare, space and cybersecurity occupy targeted niches that align closely with national and corporate priorities.

The third concerns scale: a handful of very large rounds in autonomy, compute and space based communications sit on top of a wide base of smaller and mid-sized financings, suggesting a market that is willing to fund both foundational platforms and their supporting layers.

Below, 3 visuals offer a structured view of this week’s activity.

The first visual maps the geographic distribution of the startup rounds over the past week. Deals are concentrated in the United States (19) and Europe including the UK (18), with a second band of activity in Asia (5) and Oceania (4), and a further presence in the Middle East (3) and Canada (2).

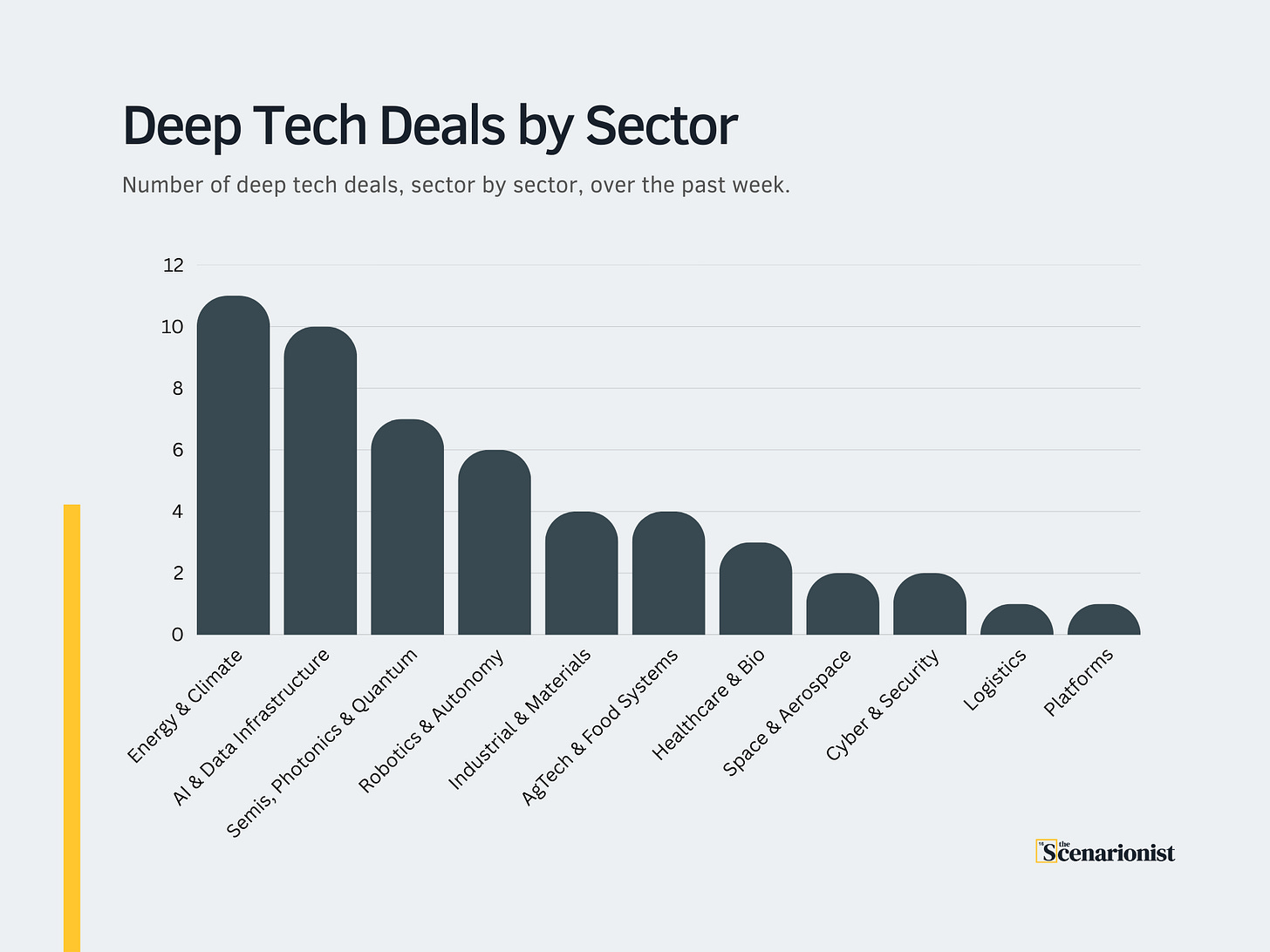

The second visual shifts from geography to sector and reorganizes the same rounds by industry.

Most of the volume falls into Energy & Climate (11) and AI & Data Infrastructure (10), which together define the core of current capital formation. A next tier consists of Semis,

Photonics & Quantum (7) and Robotics & Autonomy (6), reflecting sustained interest in compute, sensing and embodied systems.

Beyond this core, important tails appear in Industrial & Materials (4), AgTech & Food Systems (4), Healthcare & Bio (3), Space & Aerospace (2) and Cyber & Security (2), with smaller pockets in Logistics (1) and Platforms (1).

The result is an industrial profile that shows where deep tech capital is working hardest and where it is beginning to build optionality.

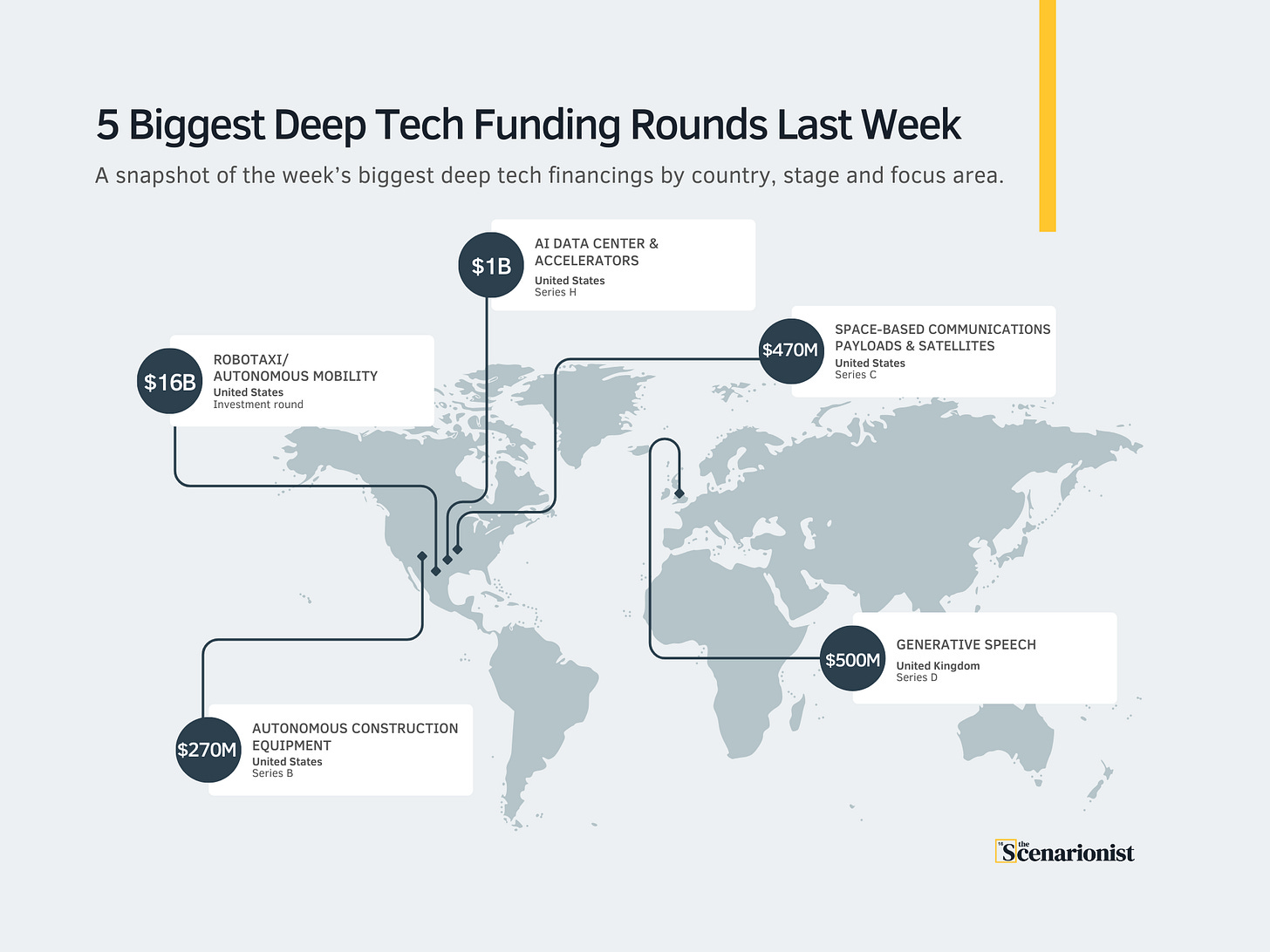

The third visual highlights the five largest rounds over last week and places them in their country, stage and thematic context, spanning robotaxis, wafer-scale AI compute, generative speech, space-based communications and autonomous construction.

The sections that follow present the full tracking of this week’s activity together with a detailed analysis of the companies, technologies and dynamics behind these numbers.

WEEK 6, 2026