📈Strategic Dual-Use IPO; ⚛️ First Fusion Power to Grid;⚡Virtual Power Plants Scale; 🔋First Grid-Scale Sodium-Ion Battery; 🚀 NASA Backs Supersonic Combustion & more.. | Deep Tech Briefing #72

Weekly Independent Intelligence on Deep Tech Startups and Venture Capital.

Thanks for reading Deep Tech Briefing, our weekly independent intelligence on Deep Tech Startups and Venture Capital.

Dear friends,

This week marks a clear inflection point in how deep tech startups are surfacing—not just as companies, but as instruments of statecraft, grid resilience, and technological sovereignty. The capital markets are beginning to re-engage, not with frothy optimism, but with sharpened precision. What we’re witnessing isn’t a return to the speculative exuberance of the SPAC-era deep tech cycle—but something more deliberate, more strategic, and far more durable.

Take the public offering of a U.S.-based launch and lunar infrastructure company. On the surface, it’s a space story. But underneath, it’s a signal: public markets are beginning to reward platforms that fuse defense-aligned revenue with commercial scalability. These aren’t just tech plays—they’re sovereign infrastructure vehicles, designed for long-duration capital and backed by contracts that move with policy, not just markets.

Zooming out, the same pattern repeats across energy, autonomy, and compute. A fusion energy facility in the U.S. has broken ground years ahead of global timelines. A virtual power plant platform in Europe has quietly passed the half-gigawatt mark. A compact reactor team just crossed a critical voltage milestone—on less power than a kitchen lightbulb. These aren’t one-off breakthroughs. They’re the visible tip of a structural realignment, where deep tech is shifting from lab-stage science to operational systems with regulatory, fiscal, and geopolitical alignment.

And it’s not just about hardware. In compute, the shift toward sovereign, regionally-optimized AI infrastructure is accelerating, driven by new chip architectures and vertically integrated deployments in strategically sensitive regions. Meanwhile, in agriculture and logistics, automation is moving from concept to contract—on subscription terms that resemble SaaS, but tied to uptime guarantees and chemical-free compliance.

What unites these stories isn’t simply technology. It’s posture. The most credible startups today aren’t moving fast and breaking things—they’re moving precisely and building things that last. They’re optimizing for throughput under constraint, not virality under hype. And in doing so, they’re reshaping what venture-scale outcomes look like in a world where resilience, policy fit, and physical credibility matter more than TAM decks.

Enjoy the read,

Giulia

✨ For more, see Membership | VC Guides | Insights | Deep Tech Catalyst

📌 This Week’s Edition

We lead with the IPO of a space and lunar infrastructure company that’s quietly reframing how public markets value dual-use platforms. The story isn’t about launches — it’s about long-duration capital anchored in sovereign strategy.

The full edition goes further:

– In Interesting Reading, we highlight signals investors are watching closely, from AI’s defensibility gap to China’s robotics posture and new incentives shaping U.S. climate tech.

– The Big Idea looks at why defense-adjacent hardware businesses are returning to public markets — and what’s different this time.

– Key Updates cover the execution layer: from grid-tied fusion and compact reactors to sovereign autonomy stacks and aerospace propulsion breakthroughs.

– In Deep Tech Power Play, we break down recent U.S. legislation and budget moves that create new openings for venture-backed infrastructure.

– And in Geek Corner, we track technical progress at the edge — materials, devices, and ML pipelines that could define the next investment cycle.

Interesting Reading

Beyond The Browser: Why Deep Tech In Physical Production Is Venture’s Next Outlier Opportunity

Crunchbase’s thesis: Deep Tech doesn't need to be sexy to scale—it needs to be precise, predictable, and painful to replicate.

→ CrunchbaseChina's commercial space startups are no longer copycats—they're taking orbit.

Venture activity is accelerating in launch systems, satellite comms, and earth observation. The U.S. is no longer alone at the frontier.

→ Read on War on the RocksAI startups are burning faster than they’re building moats.

Seattle’s top VCs say “defensibility” is no longer a strategy—it’s a story. The smart ones are building niche, speed, and data layers instead.

→ GeekWireThe U.S. just rewrote the green incentive playbook. Are your portfolio companies ready to optimize for it?

The new tax credit changes are technical—but consequential. This isn’t optional reading for energy and climate tech investors.

→ Tax FoundationWe taught robots to make decisions. We forgot to teach them to fear us.

IEEE breaks down the fundamental flaw in AI safety protocols: no incentive, no inhibition. A critical read for anyone betting on autonomous systems.

→ IEEE SpectrumChina's AI robot football match looks like a stunt—until you track the dual-use applications.

This isn’t about sports. It’s about agile robotics, multi-agent coordination, and narrative control.

→ The GuardianIndia wants in on Deep Tech manufacturing—and it’s putting real money behind it.

Ather Energy x DPIIT marks a shift from software exports to industrial policy. The next Foxconn may not be in Taiwan.

→ AsiaTechDailyIf your AI pitch deck reads like a Netflix pilot, you're not alone.

Founders are pitching LLM startups like entertainment IP. And VCs? They’re buying. Welcome to narrative-driven investing.

→ Business InsiderThe U.S. just threw gasoline on the nuclear reactor sector.

Trump’s lightning reactor program could create the single biggest tailwind for early-stage nuclear since the ‘60s.

→ Reuters

💡The Big idea

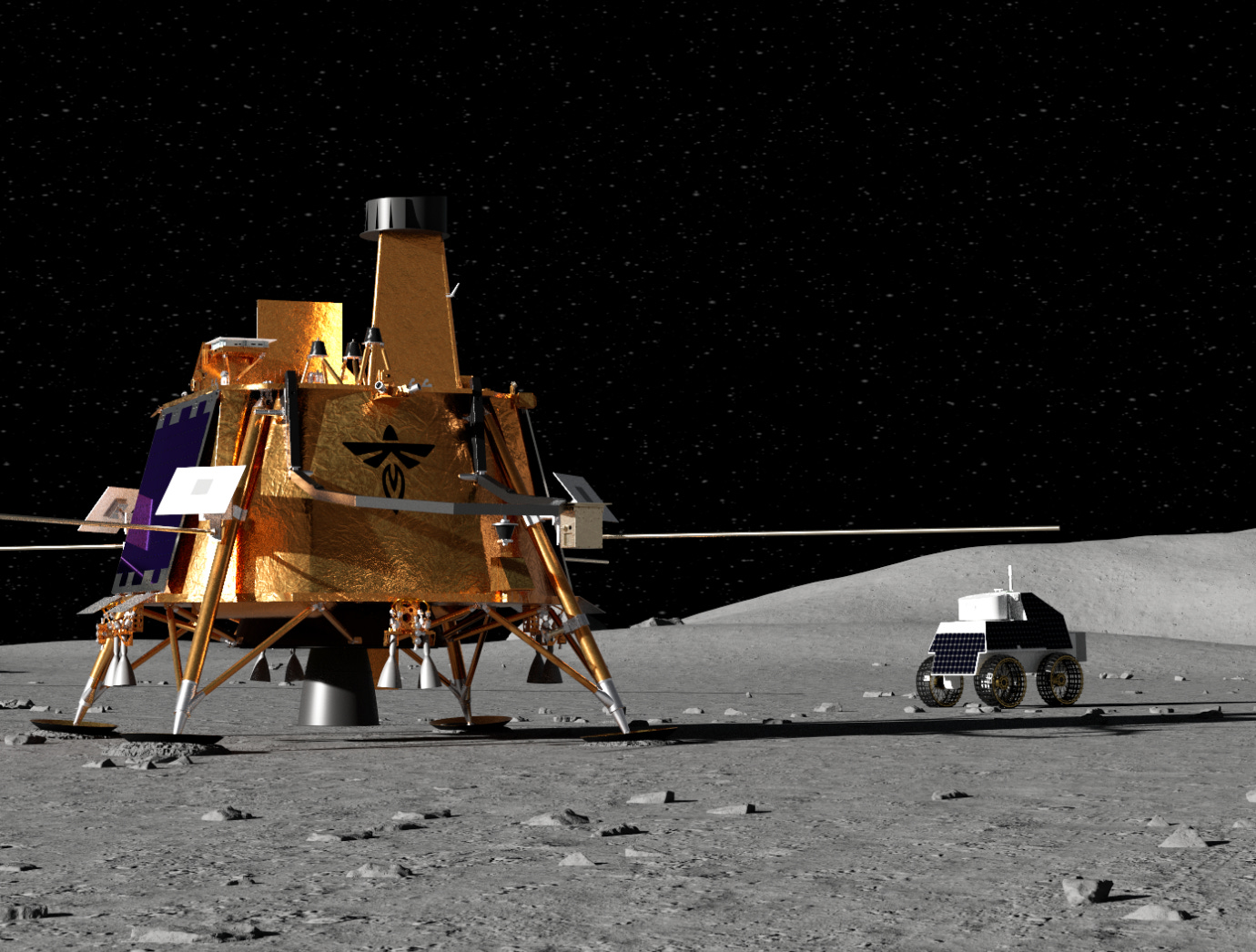

Bets on the Moon: Firefly Aerospace and the Rise of Strategic Dual-Use IPOs

A $600 million print is moving fast through the book, offering public investors exposure to sub-24-hour launch cycles and emerging lunar infrastructure. The pace at which demand is forming suggests less about the specifics of any single issuer, and more about how capital markets are