Sodium-Ion’s Working-Capital Trap: What Natron’s Wind-Down Teaches About Financing New Chemistries | Deep Tech Briefing Vol. 78

Weekly Intelligence on Deep Tech Private Market.

Welcome back to Deep Tech Briefing — the weekly space by The Scenarionist where we analyze and discuss the key events of the week shaping Deep Tech Private Market.

✨ For more, see Membership | VC Guides | Insights | Rumors | Exit

Greetings,

Deep Tech’s reminder this week: companies often fail in accounting before they fail in physics. A sodium-ion builder with real orders and a fresh U.S. line went dark because revenue sat on the wrong side of a certification stamp. Timelines stretched; working capital snapped. Meanwhile, lithium reset ~90% from the peak, stripping away the “cheaper by default” story and forcing a total-cost-of-ownership test. The playbook isn’t “don’t scale.” It’s “fund the gates”—certification, first-article approval, early warranty accruals—via milestone debt, prepaid/structured offtake, and surety wraps. Ribbon cuttings don’t meet payroll; covenants do.

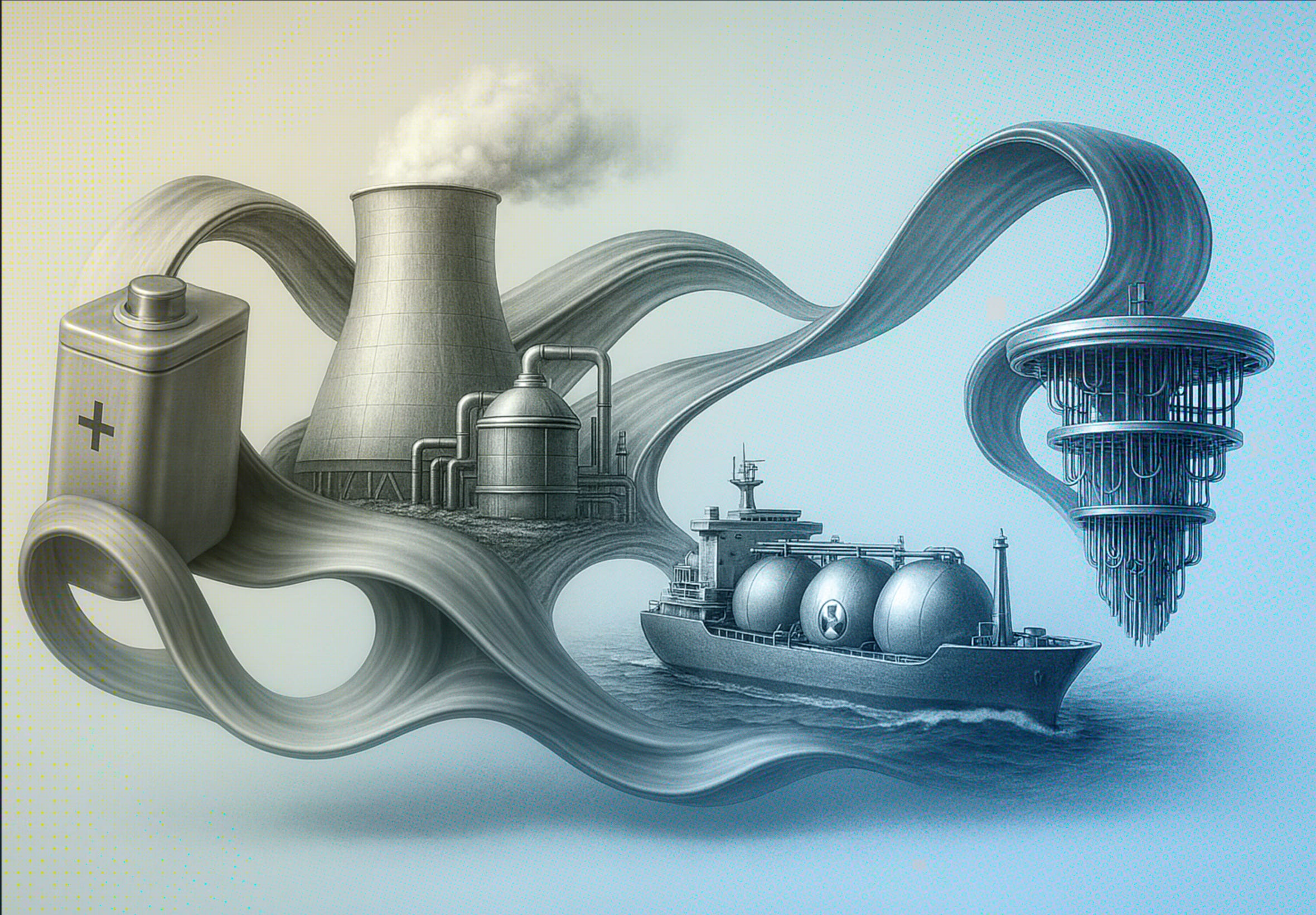

Energy and compute kept merging into one asset class. Interconnect queues are now capital-allocation events. The next AI leg looks financed like infrastructure: multi-year capacity reservations, PPAs, minimum-service commitments. That pulls in project-finance logic and shifts margin control to electrons and thermal envelopes. On the ground, hybrid systems—lithium plus hydrogen—are appearing to harden SLAs where the grid can’t. At home, an AI-orchestrated services layer is trying to turn devices, tariffs, and telemetry into annuity streams.

Firm, clean baseload advanced on execution, not slogans. Enhanced-geothermal teams standardized wells, locked in equipment, and pulled first power left by borrowing oilfield supply chains. Maritime decarb tossed a curveball: approval in principle for nuclear propulsion on long-haul cargo. If it goes from paper to steel, the bunker-cost curve changes. Hydrogen’s cold chain could follow if magnetic refrigeration trims both capex and compressor work for liquefaction. Ports are becoming multi-vector testbeds—steady marine generation, cheaper hydrogen, faster interconnects—on brownfield sites with permits and grid access already in place.

“Picks and shovels” quietly compounded. Recyclers leaned into licensing to ride scrap growth from new cell lines. Warehousing bought time-to-roadmap with mid-tier sortation. Healthcare last-mile consolidated where cold-chain integrity and compliance software drive margin. Autonomy moved via distribution-first partnerships instead of full-stack reinvention. Space tried lean reentry with a sub-€1M demonstrator. Advanced air mobility skipped greenfield by repurposing specialized facilities. Different sectors, same theme: buy time-to-capability.

Policy flashed green. Faster acquisition, multi-year munitions funding, and digital-engineering norms could compress defense procurement. Telecom is getting an AI-ops retrofit to squeeze opex out of networks. Public capital stepped in where private appetite thinned, seeding hard-tech funds to keep formation onshore. Upstream, an expanded list of “critical” minerals telegraphed tariff risk—expect offtakes and capex to reprice along the chain.

And a few sobering reads: carbon-removal markets still wrestle with MRV and buyer concentration; one LEO constellation leads but won’t monopolize; the silent killer of AI programs is organizational design.

Enjoy the read!

Interesting Reading:

U.S. critical minerals list expands — a look at how Washington is adding minerals ahead of potential tariffs, reshaping upstream capex and offtake agreements for battery and solar supply chains.

Eli Lilly opens “TuneLab” AI models to biotechs — major pharma offers its AI discovery tools to smaller biotechs, compressing drug‑discovery cycles and changing the cost of capital for startups.

BlackRock’s GIP on geothermal’s “enormous opportunity” — indicates infra‑scale capital appetite for geothermal, provided offtakes and drilling risk can be priced (paywalled; full details not disclosed).

Robinhood builds a social network — the broker is launching a social network, suggesting that distribution and community may become part of fintech moats, but also raising compliance and moderation challenges.

Grist’s report on CDR companies — an accountability overview showing measurement, reporting and verification issues and buyer concentration risks in carbon‑removal markets.

Retail investors and private markets — examines the democratization of private equity access and warns of fee stacks, liquidity risk and misaligned expectations.

Starlink’s lead but no monopoly — a market study arguing that, despite SpaceX’s head start, other LEO constellations will carve out niches for enterprise and sovereign customers.

Creative destruction, explained — a primer for board discussions about pruning legacy assets and redeploying capital towards high‑growth opportunities.

DoE vs. Musk on wind/solar claim — explores a public spat between the U.S. Department of Energy and Elon Musk over the value of variable renewables, foreshadowing debates on storage policy.

FT on data‑center power constraints — outlines how grid bottlenecks and interconnect queues are shaping data‑center siting and may slow AI expansion (paywalled; details not disclosed).

The silent killer of AI programs: leadership — argues that organizational design and incentives, not technology, determine AI success; relevant for portfolio companies scaling AI initiatives.

Europe’s defence‑tech leaders debate procurement — offers insights into how European defence start‑ups navigate government procurement and export controls.

✨Get the full Experience!

Deep Tech Briefing is just one part of The Scenarionist. Unlock the full experience with Premium!

Become a Premium member to get:

Exclusive deep tech insights and analysis

Practical VC guides and playbooks

Wisdom from leading deep tech founders, investors, and operators