Fusion’s “industrial turn” is real & Beyond | Deep Tech Briefing Vol. 77

Weekly Intelligence on Deep Tech Startups and Venture Capital.

Welcome back to Deep Tech Briefing — the weekly space by The Scenarionist where we analyze and discuss the key events of the week shaping Deep Tech Startups and Venture Capital.

If you like what you see, I encourage you to subscribe to all our pieces here.

The Week In Short:

Public and private capital continued to pour into hard tech while policymakers signalled shifting priorities. London launched £12.6 million in agtech competitions and eight U.S.‑Indian venture firms unveiled a $1 billion alliance to fund India’s deep‑tech startups. CoreWeave bought reinforcement‑learning startup OpenPipe to bolster its AI training capabilities as GPU‑backed loans proliferated. General Atomics delivered ITER’s pulsed magnet and fusion startups lined up billions in new funding. The Trump administration emphasized nuclear power over wind and solar to support an AI race with China while advanced geothermal projects advanced with major financing. Record robotics funding, drone breakthroughs, AI legislation delays and new circular‑economy technologies rounded out a week marked by both optimism and caution.

In Today’s Briefing:

The Big Idea: Fusion’s “industrial turn” is real.

Signals in the Data: GPU‑backed loans are surging

Signals from the Frontier: Power, Testbeds, and the Pipes That Matter

Interesting Reading: From AI monetization to the compute layer going public, risk-driven regulation is rewriting returns and liquidity paths.

Interesting Report: MIT on the GenAI divide- GenAI Divide: Why Most Enterprise AI Fails.

Closing Thought: This cycle rewards infrastructure over novelty: secure firm power, run the testbeds, own the pipes—and lock it in with contracts.

Enjoy the read!

✨ Before Go Ahead:

Deep Tech Briefing is just one part of The Scenarionist experience. To enjoy the full experience, become a Premium Member!

Becoming a Premium Member of The Scenarionist means you also get full access to our complete archive of Deep Tech intelligence, actionable Playbooks, rigorous VC Guides, and founder-ready strategies you won’t find anywhere else — all based on our independent research, original deep dives, and exclusive insights with the world’s top Deep Tech experts, founders and investors.

If you’re serious about Deep Tech and want a real edge in practical knowledge and strategic thinking, The Scenarionist Premium is the one resource you can’t afford to miss.

The Big Idea:

Fusion’s “industrial turn” is real.

Fusion energy crossed several symbolic thresholds this week, moving it from science fiction toward industrial reality. General Atomics shipped the last central solenoid module for ITER, the world’s largest pulsed superconducting magnet. The six‑module magnet stands nearly 60 feet tall, weighs more than 1 000 tons and took 15 years to build.

It will generate magnetic fields strong enough to squeeze superheated plasma within ITER’s tokamak, proving that high‑temperature superconducting (HTS) tapes can sustain the extreme currents needed for fusion.

This milestone coincides with a new wave of private fusion funding. Commonwealth Fusion Systems raised an $863 million Series B2, bringing its total capital to nearly $3 billion and positioning it to build Sparc, a tokamak designed with HTS magnets and slated for operation by 2026. Helion, TAE, Pacific Fusion and others have each raised hundreds of millions, while General Fusion and Tokamak Energy continue to push alternative reactor architectures.

Why now? Three interlocking advances — more powerful computer chips, more sophisticated AI and HTS magnets — have collapsed the timeline for reactor design and control.

GPUs and specialized chips let researchers simulate plasma behaviour and optimize reactor geometry; AI algorithms help manage unstable plasmas; and HTS materials, like REBCO tape, can carry larger currents at relatively higher temperatures, enabling compact and energy‑efficient magnets. The U.S. Department of Energy’s 2022 demonstration of a net‑energy‑positive fusion experiment proved the science, catalyzing investors who once dismissed fusion as perpetually “decades away.”

What does this unlock? If companies can achieve commercial breakeven, fusion offers baseload power without greenhouse‑gas emissions or long‑lived radioactive waste. Industrial customers — from data centres to hydrogen producers — could secure 24/7 electricity without relying on fossil fuels. Google has already agreed to purchase half the output from CFS’s planned 400‑MW plant in Virginia, signalling that hyperscalers view fusion as a hedge against grid instability. T

he supply chain for HTS magnets will also benefit: General Atomics’ magnet programme created a domestic manufacturing base for HTS tape and large‑scale magnet fabrication. Startups like Pacific Fusion and Marvel Fusion are exploring inertial confinement methods that could leverage existing semiconductor fabs. Longer term, compact reactors could enable off‑grid industrial clusters or even space‑based power systems.

What could go wrong? These projects are capital‑intensive; Sparc’s cost is undisclosed but will likely exceed billions. General Fusion recently laid off a quarter of its staff after funding delays, underscoring financing fragility.

Fusion reactors will require rigorous regulatory approval and long‑term waste management plans. Supply chains for HTS materials rely on rare‑earth elements and complex manufacturing; scaling may create bottlenecks.

Talent shortages — fusion engineers, cryogenics specialists and AI‑control experts — could slow progress. Meanwhile, the macro environment is volatile: shifts in U.S. energy policy, export controls and geopolitical tensions could redirect subsidies away from fusion toward other technologies.

For investors, fusion remains a high‑capex bet with potentially extraordinary rewards if technical milestones are met and the political winds stay favourable.

Signals in the Data:

GPU‑backed loans are surging

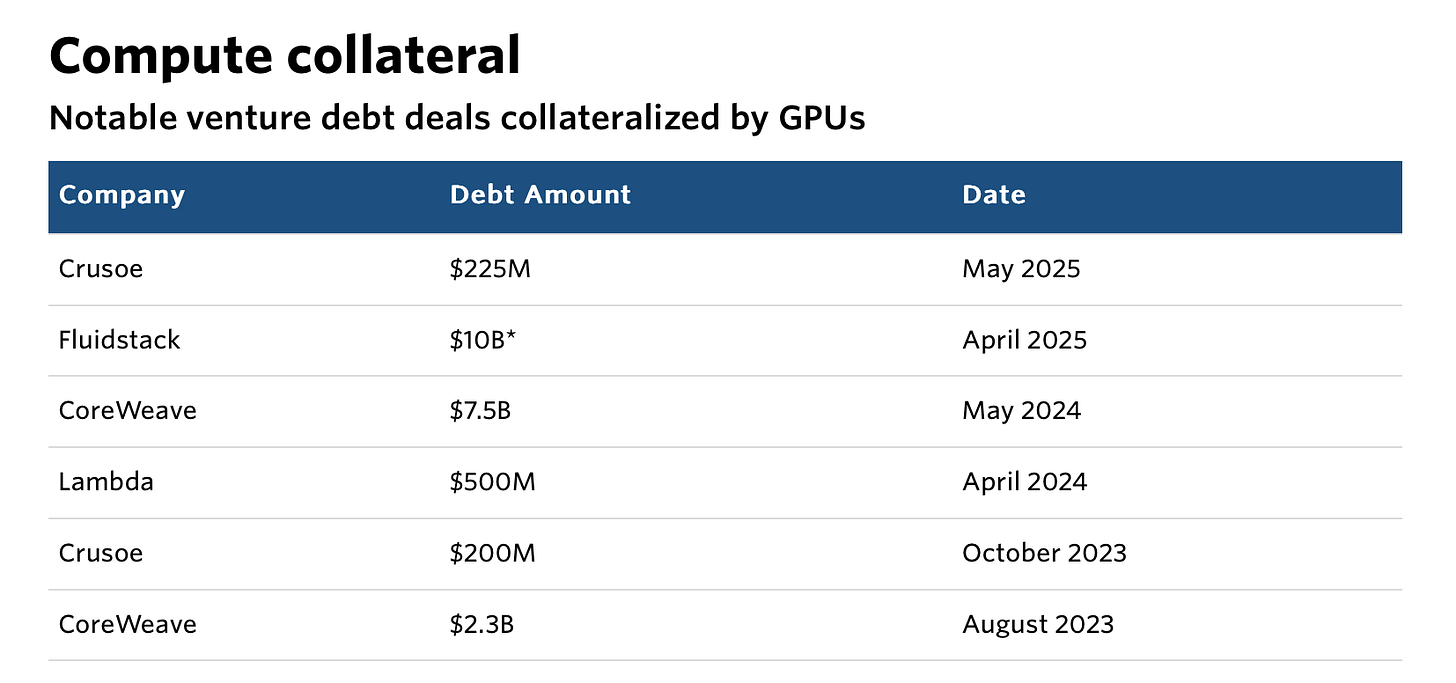

PitchBook’s table of notable GPU‑collateralized venture debt deals shows that infrastructure providers like CoreWeave and Crusoe have borrowed billions using their GPU inventories as collateralpitchbook.com. CoreWeave’s $7.5 billion and $2.3 billion financings in 2024 and 2023 dwarf earlier deals, highlighting how capital‑intensive cloud compute has become.

Deal sizes vary widely.

While CoreWeave’s loans run into the billions, smaller players like Crusoe and Fluidstack secured $225 million (May 2025) and an estimated $108 million (April 2025)pitchbook.com. The variability suggests lenders differentiate based on scale, asset quality and revenue contracts.

Depreciation risk.

Bankers worry that GPUs depreciate rapidly; chips can be worth more than their sticker price one quarter and obsolete the next. Loan structures must account for this, affecting collateral coverage ratios and loan durations.

Policy implications.

As AI chip exports face potential export controls, collateral value could swing with geopolitics. VC‑grade investors should watch for secondary markets and insurers that might emerge to hedge GPU depreciation risk.

Signals from the Frontier:

Power, Testbeds, and the Pipes That Matter

Capital, policy, and engineering lined up this week around a simple thesis: the winners are building firm power, industrial testbeds, and the coordination layers that sit in the critical path of transactions—whether those transactions are electrons, parts, or state updates across software agents.

Start with cross-border capital formation. Eight U.S. and Indian investors assembled a $1B+ India Deep Tech Investment Alliance to fund Indian-domiciled startups over 5–10 years. The explicit link to New Delhi’s new RDI incentive scheme matters: it encourages local incorporation in categories that typically flee abroad for capital—semiconductors, space, AI, robotics, quantum—while creating a standing conduit for co-investments and policy feedback. Expect better access to labs and procurement if the alliance executes on its “domicile-first” premise.

On AI infrastructure, CoreWeave agreed to acquire OpenPipe, a YC-backed startup that trains and tunes production agents. Read this as vertical integration at the “training + serving” seam: agentic systems make retrieval calls, invoke tools, and maintain state for long stretches, which pins steady GPU hours. By owning the tuning pipeline and the runtime, a GPU utility can sell performance guarantees rather than raw cycles—stickier revenue with better unit economics than bursty inference.

Regulatory clocks are shifting but not disappearing. Colorado amended its AI law, pushing enforcement back to June 30, 2026 while keeping the spine of risk management, impact assessments, and disclosures. Translation for deployers of “high-risk” systems: more documentation and post-deployment accountability are table stakes; you’ve gained time, not a reprieve.

Energy policy is tilting, and capital is moving accordingly. The U.S. administration signaled preferential support for nuclear over wind and solar on the grounds of domestic supply chains, implying friendlier loan guarantees and tax treatment for fission developers and fuel-cycle companies. Whatever your politics, the underwriting takeaway is straightforward: firm power assets look more bankable under this posture.

Turning Waste and Heat Into Assets

Two technical stories advanced on the baseload front.

First, waste-to-fuel. Curio reported lab-scale validation with multiple U.S. national labs for steps in its NuCycle™ process to turn spent nuclear fuel into enrichment-ready material while embedding safeguards. For non-specialists: think of a chemical “re-sorting line.” Spent assemblies are de-sleeved, conditioned (e.g., voloxidation), and separated into streams so that useful isotopes can be refabricated into fuel rather than buried. Engineering risk now contends with economics, safeguards, and scale-up: capex for hot cells, throughput, waste handling, and the licensing pathway.

Second, fusion finance. Commonwealth Fusion Systems added roughly $863M, bringing total equity near $3B, with corporate and tech strategics in the cap table and a Virginia site tied to a Google offtake in the early 2030s. That’s not near-term relief for data centers, but it’s a credible signal that fusion has crossed from “moonshot grant” to infrastructure-adjacent underwriting—even as the technical risk remains high.

Closer in, advanced geothermal is graduating from promise to contracts. TechCrunch tracked progress at Fervo and Sage: deeper, hotter wells (e.g., ~16,000 feet) and pressure-assisted designs paired with turbine supply and licensing moves. The appeal for compute: 24/7 profiles without grid-scale storage and heavy reuse of oilfield services. The diligence needles: levelized cost at scale, sustained flow rates after thermal drawdown, and how hyperscalers’ offtake backstops project finance.

Heavy industry added its own provocation. Hertha Metals says it can go ore-to-steel in one electrically heated step(~1,600°C) while splitting natural gas into carbon and hydrogen in-situ, claiming cost parity (or better) with conventional steel and >50% emissions cuts—more if green hydrogen is used. Pilots reportedly run at ~1 t/day; real scrutiny belongs on electricity price, furnace life, refractory maintenance, ore grade tolerance, and the step-change in opex/capex vs. blast furnaces + BOF/EBT. Side businesses like high-purity green iron for magnets could monetize intermediates while the core line scales.

Autonomy and the Industrial “Cold Steel” Layer

Uber’s robotaxi rollout will include Avride in Dallas, leveraging Hyundai’s Ioniq 5 platform. Avride already runs delivery robots on Uber Eats and Grubhub; adding passenger service puts both SKUs under one marketplace, compressing go-to-market risk by pairing an OEM-grade EV with a route-rich aggregator. The signal here isn’t “Level 4 is solved” so much as “deployment templates are maturing.”

Inside the warehouse, Interroll bought Dutch startup Sortteq for its modular chain-belt sorter, with published throughput up to ~10,000 parcels/hour. This is classic “picks and shovels”: retrofits that squeeze more flow from fixed footprints, supported by global service networks that turn uptime into the real moat. Expect Interroll to industrialize the design and push it through existing integrator channels.

Defense tech continues to compound. Axios profiled Vector, a Utah firm pitching “modern warfare as a service.” Beyond the slogan are useful details (e.g., fiber-optic spools for jam-resistant FPV control) that suggest product pulled from operational feedback loops. For generalist funds that sat out defense, note the revenue cadence and iteration speed when the end-user is institutional and the testbed is live.

Meanwhile, Anduril’s Fury—originating at Blue Force Technologies in North Carolina before the 2023 acquisition—is nearing flight tests. This is less about any one aircraft and more about regional test corridors that co-locate vendors, regulators, and ranges, cutting cycle time from design to data.

Europe is in motion, too. Robotics deal value is pacing toward a record year across healthcare, logistics, and defense. That momentum opens exit optionality and supports business models where recurring revenue lives in autonomy upgrades, service, and fleet orchestration rather than metal margins.

Space: Control the Testbeds, Then the Standards

Interlune secured up to $4.84M from the Texas Space Commission to build a Lunar Regolith Simulant Center of Excellence near NASA’s Johnson Space Center and the forthcoming Texas A&M Space Institute campus. “Moon dirt” sounds quaint, but high-fidelity simulants are the gating testbed for mining, mobility, excavation, and construction hardware. The entity that runs the testbed often sets the test protocols—soft power over future supplier standards.

On the other end of a mission, Orbital Paradigm argued that reentry can turn profitable ahead of crewed European vehicles. The near-term plan: a no-propulsion, no-chute orbital demonstrator to derisk thermal protection and comms, followed by a scaled Kestrel capsule with propulsion and a parachute targeting recovery in the Azores. A monthly cargo cadence with positive unit economics is the prize: a standardized “return bus” for microgravity manufacturing and research.

Closer to the body, Norway’s Nåva Space unveiled a training version of its suit platform and aims to be Europe’s commercial supplier of modern spacesuits later this decade. Spacesuit vendors define critical interfaces—mobility joints, life-support couplings, dust mitigation—so a European entrant reduces single-source risk and diversifies supply for ESA and commercial stations.

Food, Ag, and Circular Materials

The U.K. earmarked £12.6M for agtech via two Innovate UK competitions spanning on-farm automation, controlled environments, and robotics. These programs are modest in size but important for market making: they validate categories, standardize metrics, and seed consortia that later attract private follow-on.

On materials, Refiberd’s hyperspectral imaging plus ML classifies textiles—including complex blends—non-destructively and at speed. In practice: a hyperspectral camera captures a “cube” of reflectance/absorbance across wavelengths; the model maps those signatures to fiber types and flags contaminants. If robust on post-consumer streams, this is the missing classification layer that lets automated sorting feed mechanical and chemical recyclers with clean inputs—turning digital product passports from paperwork into verifiable physics.

The Ledger After the Plant

Stripe introduced Tempo, a new blockchain initiative, with design partners including Anthropic and OpenAI, that serves as a neutral, shared ledger for automated workflows, recording events and settling money in the same place. In practice, it logs each step—model call, data pull, label print, courier handoff—in strict order, then executes the matching financial actions: per-action micropayments, revenue splits across vendors, escrow, and refunds. That single, append-only record gives every party the same history, making integrations simpler, reconciliation faster, and audits more reliable.

Technically, Tempo is an append-only state machine with deterministic ordering, tamper-evident records, and low-jitter confirmation designed for enterprise-grade uptime and observability. Economically, it compresses working-capital cycles by accelerating cash clearance, lowers dispute and chargeback costs, and reduces counterparty risk by replacing bespoke settlement layers with a common backbone.

The open question is performance: how Tempo handles peak loads, how quickly entries achieve finality, and how resilient it is when parts of the network fail. If it delivers fast, predictable confirmations with robust monitoring and fault tolerance, Tempo moves beyond “crypto at checkout” and emerges as critical infrastructure—a dependable backbone for coordinating work and money across automated, distributed systems at scale.

How to Underwrite the Signals

Baseline power is strategy, not scenery. Between Washington’s nuclear tilt, Curio’s waste-to-fuel progress, geothermal’s maturation, and fusion’s capital base, the investable theme is firm, clean, financeable power coupled to compute and process-heat loads. Structure project equity around hyperscaler or municipal offtake, and assume documentation burdens will grow under emerging AI and energy disclosure regimes.

Own the testbeds and the pipes. Interlune’s simulant center is a tollbooth for lunar hardware. Orbital Paradigm wants to be the default return bus. CoreWeave is stitching agent training into its GPU utility. Stripe is convening design partners around state coordination at scale. These are not point products: they are positions that turn demand variability into high-margin services.

Industrial autonomy is “platform + distribution.” Avride piggybacks on Uber’s marketplace; Interroll’s buyunderscores the moat in service networks; defense startups like Vector convert live feedback into product velocity; European robotics deal flow creates exit optionality. If you’ve avoided hardware, reframe: recurring revenue is in upgrades, uptime SLAs, and fleet orchestration.

The common thread: the strategically important companies this cycle are not merely building clever devices or clever code; they’re capturing the indispensable layers—firm power, industrial testbeds, and deterministic pipes—where reliability and distribution compound.

Interesting Reading:

🔗 Perplexity’s new AI bet: Monetize the bots, pay the publishers (Fast Company)

Perplexity is trying a bold revenue-sharing play with publishers—positioning itself as the AI search startup that might finally crack the monetization model.

🔗 Tesla needs a new story (Fast Company)

Once the disruptor, now at an inflection point: Tesla faces slowing sales and investor fatigue as the market waits for a credible “next chapter.”

🔗 AI in the balance: can regulators keep up with the tech giants? (Financial Times)

The FT examines whether regulators can realistically keep pace with AI’s exponential scale—and what that means for founders and investors operating in the gray zones.

🔗 Nvidia-Backed Cloud Provider Lambda Hires Banks for IPO (The Information)

Backed by Nvidia, Lambda is lining up for an IPO—spotlighting how the public markets are shifting attention from AI models to the compute layer fueling them.

🔗 CVC secondaries flagship collects $6.5bn as it nears target (Secondaries Investor)

$6.5B raised in secondaries signals deep liquidity in private markets—critical context for late-stage deep-tech fundraising and exits.

🔗 OpenAI, Microsoft, and LinkedIn Team Up to Train Workers for AI Jobs and Chips (Barron’s)

A workforce push at the intersection of AI and semis—showing how talent development is becoming as strategic as model training or chip supply.

Interesting Report:

MIT on the GenAI divide- GenAI Divide: Why Most Enterprise AI Fails.

What it says. The report argues there’s a GenAI Divide: lots of trials, little transformation. Only a small share of embedded, learning-in-workflow pilots reach production and deliver measurable P&L impact; near-term ROI clusters in back-office automation while Tech/Media lead sector change today.

What’s interesting. Buy/partner beats build; “shadow AI” signals bottom-up demand; BPO/agency displacement drives savings though budgets overweight sales/marketing materially.

Questions.

1) Can vendors with persistent memory + feedback loops sustain superior deployment across verticals?

2) Is BPO/agency replacement the durable wedge—what payback and post-tuning gross margin?

3) How do we convert shadow AI into pipeline while clearing security/governance?

Closing Thought:

The past week’s tapestry of deals and policies reinforces a simple lesson: deep‑tech investing is fundamentally about timing and tolerance for uncertainty. Subsidies can be granted or revoked, as seen in Colorado’s AI law delay and Trump’s pivot from wind to nuclear. Breakthrough technologies like fusion and green steel are attracting billions, yet cash crunches and scaling risks remain. As venture debt pushes into GPU‑backed loans, hardware depreciation risk becomes a financial question. For the coming weeks, watch how regulators refine AI and energy policies, whether Fervo and CFS meet their milestone schedules, and if industrial and defence startups can convert prototypes into profitable production. Strategic patience, grounded in unit‑economics and policy foresight, will distinguish the winners from the footnotes.